Govt Raises Petrol and Diesel Taxes But Spares Consumers From Price Hike

New excise duty: ₹13 (petrol), ₹10 (diesel) per litre from April 8. PSU oil firms to absorb cost; no change in retail price. Read more at Dynamite News

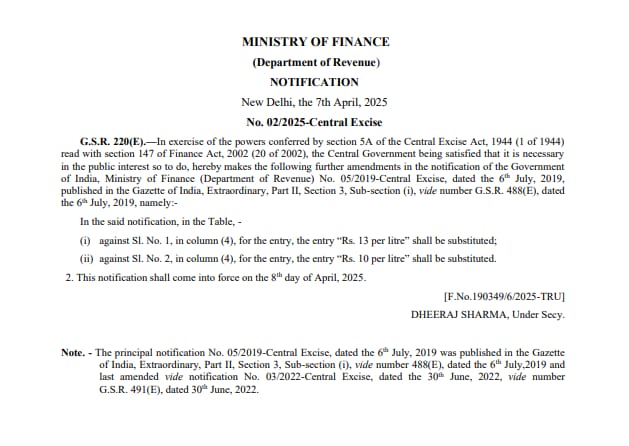

New Delhi: In a rare move, the Centre increased excise duty on petrol and diesel by ₹2 per litre, effective from April 8, 2025, but assured no immediate rise in retail prices. The Petroleum Ministry confirmed oil companies won't pass this tax hike to consumers.

The government has set the new excise duty at ₹13 per litre for petrol and ₹10 per litre for diesel. This tax increase operates under provisions of the Central Excise Act, 1944 and the Finance Act, 2002.

Also Read |

Govt increases excise duty on petrol, diesel by Rs 2 per litre

In an unusual move, public sector oil marketing companies will absorb this additional cost rather than passing it to consumers, meaning fuel pumps will continue displaying current prices without revision.

Also Read |

Central government supports Kumbh Mela but they do not even look at Gangasagar

PSU Oil Marketing Companies have informed that there will be no increase in retail prices of #Petrol and #Diesel, subsequent to the increase effected in Excise Duty Rates today.#MoPNG

— Ministry of Petroleum and Natural Gas #MoPNG (@PetroleumMin) April 7, 2025

The decision breaks the usual pattern where excise hikes directly impact fuel prices. This comes amid global oil market volatility, ongoing inflation concerns and recent state election results.

Dynamite News

Dynamite News