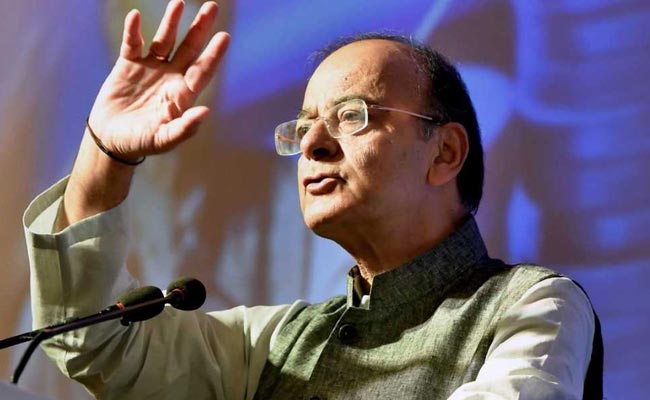

FM Jaitley at IBA Annual Meeting: Stressed assets core area of concern

FM Arun Jaitley stated that although the banking sector has seen a substantial revamp, the problem of stressed assets still persists and remains the core area of concern.

Mumbai: Union Finance Minister Arun Jaitley on Friday stated that although the banking sector has seen a substantial revamp, the problem of stressed assets still persists and remains the core area of concern.

He said the capacity of the banking system needs to be improved and a push must be given to private sector investment, adding that the sector would receive full support from the Centre for the same, while addressing the inaugural session of the 70th Annual General meeting (AGM) of Indian Bank Association (IBA).

Also Read: FM Jaitley dismisses corruption in Centre, says excessive cash dealings 'unsafe'

"India has shown its ability to grown and reform, even when the world economy is slowing down. The Indian public is more supportive of reforms, and the ability to face challenges is now better. Two things need to be given priority- improving banking system's capacity and encouraging private sector investment. With analysis being done regarding the root of the issues, quick solutions are needed as the ability has to be strengthened. Centre will back the banking sector for this," added Jaitley.

Also Read | FM Jaitley: Jan-Dhan Yojana was perceived as Centre's usual half-heartedly-implemented scheme

However, he lauded the strides made in the banking sector owing to the process of financial inclusion, and being the 'lifeline of the economy', for a large number of credits to its advantage.

"The strides made in financial inclusion are a landmark in the success of the banking system. Every household must have a bank account, and this was achieved after surpassing a large number of obstacles, including geographical hurdles, and left-wing extremism. This created the ability to target support to those where support must go," said Jaitley.

Jaitley highlighted that efforts like the demonetisation drive were rolled out to consciously create a difference in the spending habit pattern of people, and give a much-needed push to digitization.

"Demonetisation was the largest currency exchange program, which replaced 86 percent of total currency. The research shows that it was successful, conceptually and theoretically. It led to an expansion in digitisation, tax base and assesses, and has made cash dealings unsafe," said Jaitley.

Also Read |

FM Jaitley: Increasing FDI inflow testament to global confidence in Indian economy

Also Read: FM Arun Jaitley- Fall out of demonetisation on predicted lines

With regards to the Goods and Services Tax (GST), Jaitley claimed that the implementation was 'smoother than expected', adding that a robust mechanism has been institutionalized.

"The GST is working smoother than expected, with the Centre-State collaborated decision making being institutionalized. Any concerns about the taxation system can be addressed via a robust mechanism. The coming months will see an expansion in the number of taxpayers brought under the network," said Jaitley.(ANI)

Dynamite News

Dynamite News