Business: RBI reduces reverse repo rate by 25 basis points from 4 pc to 3.75 pc

The Reserve Bank of India (RBI) today reduced the reverse repo rate by 25 basis points from four per cent to 3.75 per cent in a bid to inject liquidity in financial markets. However, the repo rate remains unchanged

Mumbai: The Reserve Bank of India (RBI) today reduced the reverse repo rate by 25 basis points from four per cent to 3.75 per cent in a bid to inject liquidity in financial markets.

Also Read: Banks not following RBI directive on gold margin calls

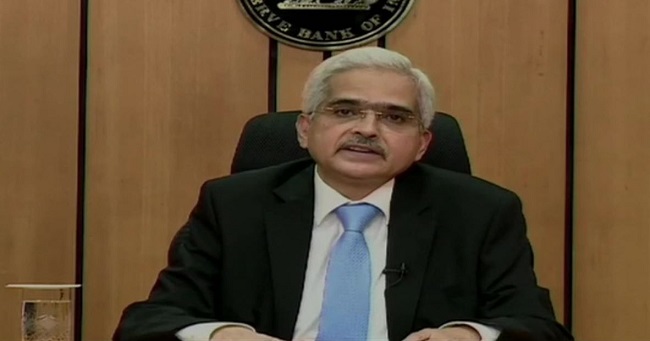

However, the repo rate remains unchanged.This comes amid the COVID-19 pandemic and the subsequent countrywide lockdown.RBI Governor Shaktikanta Das said the liquidity injection has been 3.2 per cent of GDP since February 6 to March 27.

Also Read |

Business: RBI raises repo rate by 40 basis points to 4.40 pc with immediate effect

RBI Governor’s address to the media https://t.co/uhsojdIeSF

— ReserveBankOfIndia (@RBI) April 17, 2020

"The RBI has been taking pro-active measures and monitoring the situation closely. The contraction in exports at 34.6 per cent has been much worse than 2008-09 global financial crisis," Das said.

Also Read: EMIs put on hold, big-bang interest rate cut as RBI joins fight against coronavirus

Also Read |

Transmission of rate cuts to improve further; credit growth momentum gathering pace: RBI chief

He said that India is expected to post a "sharp turnaround" by growing at 7.4 per cent in 2020-21."For 2020-21, International Monetary Fund projects sizable reshaped recoveries, close to 9 percentage points for the global GDP.

India is expected to post a sharp turnaround and resume its pre-COVID, pre-slowdown trajectory by growing at 7.4 per cent in 2020-21," the RBI Governor said. (ANI)

Dynamite News

Dynamite News