Business: RBI cuts repo rate by 40 bps to 4 pc to increase credit flow

The Reserve Bank of India (RBI) on Friday reduced repo rate by 40 basis points to 4 per cent in an effort to further boost liquidity in the economy which has been reeling under the impact of COVID-19 induced countrywide lockdown.

Mumbai: The Reserve Bank of India (RBI) on Friday reduced repo rate by 40 basis points to 4 per cent in an effort to further boost liquidity in the economy which has been reeling under the impact of COVID-19 induced countrywide lockdown.

Also Read: India sees biggest spike in COVID-19 with 6,088 cases, count is horrific

Also Read |

Business: RBI hikes repo rate by 50 bps to 4.90 per cent

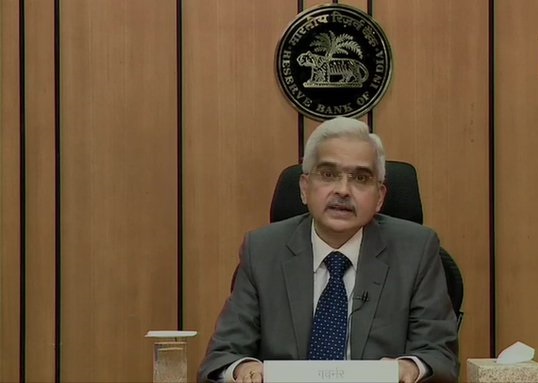

The repo rate cut by 40 basis points from 4.4 % to 4%. Reverse repo rate stands reduced to 3.35%: Reserve Bank of India (RBI) Governor Shaktikanta Das pic.twitter.com/z9N8fr7vRT

— ANI (@ANI) May 22, 2020

As a result, the reverse repo rate stands at 3.35 per cent, said RBI Governor Shaktikanta Das. The six-member monetary policy committee (MPC) voted 5:1 in favour of the decision.

Also Read |

Business: RBI raises repo rate by 40 basis points to 4.40 pc with immediate effect

Repo rate is the rate at which a country's central bank lends money to commercial banks, and the reverse repo rate is the rate at which it borrows from them. (ANI)

Dynamite News

Dynamite News